What Is Cost Per Acquisition? Guide to Boost Your ROI

What Is Cost Per Acquisition?

Ever heard the term Cost Per Acquisition (or CPA) thrown around and wondered what it really means for your business?

Put simply, it’s the total price you pay to win over a single, paying customer.

CPA is one of those vital metrics that cuts through the noise.

It doesn’t just show you how much you’re spending, but how smartly you’re spending it to get people to take action.

What Is Cost Per Acquisition? Getting a Grip on Your Marketing Efficiency

Imagine you’re running a stall at a local fair, trying to get people to play your ring toss game. You spend £100 on flashy signs and a megaphone to draw in the crowds. By the end of the day, 10 people have paid to play. Your Cost Per Acquisition here is £10 – it cost you £10 in marketing to get each person to take that final step.

In the world of business, this is exactly what we mean by CPA. It’s the total cost of a marketing campaign divided by the number of new customers (or ‘acquisitions’) it brought in. Think of it as your North Star for measuring how efficient your marketing actually is.

Why CPA Is So Important

Unlike fluffier metrics like clicks or impressions that only track initial interest, CPA zeroes in on the final, desired outcome. It gives you the real-world cost of getting someone to complete a specific, valuable action, such as:

- Making a purchase on your eCommerce site

- Filling out a lead generation form

- Signing up for a free trial

- Downloading your company’s app

This makes it an absolute must-have for budgeting and strategy. When you know your CPA, you can confidently pour your marketing budget into the channels that deliver the best results for the lowest cost. If one campaign has a CPA of £20 and another has a CPA of £80, you immediately know where to focus your efforts for a much better return.

Key Takeaway: A low CPA means your marketing is efficient – you’re spending less to win each new customer. A high CPA is a red flag that your campaigns might not be hitting the mark, forcing you to spend more for each conversion and potentially eating into your profits.

Breaking Down the CPA Formula

To really get to grips with CPA, you need to understand its building blocks. The formula itself is dead simple, but knowing what actually goes into each part is crucial for getting an accurate picture.

Let’s break down the two core components you’ll be working with.

Core Components of the CPA Formula

| Component | What It Includes | Example |

|---|---|---|

| Total Cost of Campaign | All expenses tied to a specific marketing campaign over a set period. This isn’t just ad spend; it includes agency fees, software subscriptions, and even the salaries of the team members involved. | A company spends £5,000 on a Google Ads campaign in one month. |

| Number of Acquisitions | The total count of desired actions completed as a direct result of that campaign. This must be a clearly defined action, like a completed sale or a submitted contact form. | The campaign results in 250 new customers making a purchase. |

What Is Cost Per Acquisition? So, using the example from the table, the calculation would be £5,000 divided by 250 acquisitions. This gives you a CPA of £20.

That one simple figure tells a powerful story. It means for every £20 you spent on that Google Ads campaign, your business successfully brought in one new customer. It’s insights like these that give you a true read on your campaign performance and overall marketing health.

How to Calculate Your True Cost Per Acquisition

Knowing what Cost Per Acquisition means is one thing, but being able to calculate it properly is where the magic really happens. The basic formula is simple enough: divide your total marketing costs by the number of acquisitions. The secret to getting a genuinely useful CPA, though, lies in what you decide to include in those “total costs.”

A classic mistake is to just look at your direct ad spend. This gives you an incomplete picture and, frankly, a misleadingly low CPA. To find your true Cost Per Acquisition, you need to tally up every single penny that went into your marketing efforts over a set period.

Uncovering All Your Marketing Costs

Your total marketing cost isn’t just what you pay Google or Meta. It’s the full investment needed to run your campaigns and keep your marketing function ticking over. Think of it like baking a cake – the flour and sugar are the obvious ingredients, but you also have to account for the electricity that powers the oven and the price of the mixing bowl itself.

To get a number you can actually rely on, make sure you’re including:

- Direct Ad Spend: This is the straightforward one – the money paid directly to ad platforms like Google Ads, Facebook Ads, or Amazon PPC.

- Team Salaries & Freelancer Fees: The slice of salaries for your in-house marketing team, or the fees you pay to agencies and freelancers.

- Software & Tool Subscriptions: Any costs for the tech stack you use, from analytics software and CRM platforms to email marketing tools and design subscriptions.

- Content & Creative Production: The expenses for creating your ad visuals, shooting videos, writing blog posts, or designing those all-important landing pages.

When you add all of these up, you get a proper, comprehensive view of your marketing investment for a specific month or quarter.

A Practical CPA Calculation Example (What Is Cost Per Acquisition?)

Let’s walk through this with a real-world scenario. Imagine a UK-based online shop that sells handmade leather goods. They want to work out their CPA for a big sales campaign they ran last month.

Here’s how their costs break down:

- Google Ads Spend: £3,000

- Facebook Ads Spend: £1,500

- PPC Agency Fee: £1,000

- Marketing Software Subscription (for analytics): £100

- Total Marketing Costs = £5,600

During that same month, the campaign brought in 200 sales (their acquisitions).

Now for the calculation:

CPA = Total Marketing Costs / Number of Acquisitions

CPA = £5,600 / 200

CPA = £28

This means that for every new customer they brought in, it cost them £28. That figure is now an actionable benchmark they can use to judge profitability and make smarter decisions for their next campaign.

Crucial Distinction: CPA isn’t the same as Cost Per Lead (CPL) or Customer Acquisition Cost (CAC), even though you’ll often hear the terms used interchangeably. CPL is about the cost of getting a potential customer’s details (a lead), whereas CPA and CAC usually measure the cost of securing an actual paying customer. Make sure your definition of an “acquisition” is consistent everywhere you track it.

Getting a firm grip on your acquisition cost is fundamental for any kind of sustainable growth. For a more detailed guide, there are great resources on how to accurately calculate customer acquisition cost to ensure you’re tracking your investment with precision. This number becomes even more powerful when you put it up against the lifetime value of a customer. If your CPA is much lower than your Customer Lifetime Value (LTV), you’ve got a profitable business on your hands. To get the full picture of your marketing ROI, check out our guide on how to calculate customer lifetime value.

Understanding CPA Benchmarks Across UK Industries

Figuring out what a “good” Cost Per Acquisition should be isn’t as simple as plucking a number from thin air. What spells success for one business could be a total financial disaster for another. The real secret is realising that CPA benchmarks aren’t universal; they’re deeply tied to the industry you’re in.

Think of it like this: a bespoke furniture maker might happily spend £200 to land a customer buying a £3,000 handcrafted dining table. Meanwhile, an online shop selling phone cases for £15 would go bust almost instantly with that same acquisition cost. Everything changes based on your business model, profit margins, and how much a customer is worth over their lifetime.

Why CPA Varies So Much

So, what causes these massive differences in acquisition costs between sectors? Getting your head around these factors will help you set realistic expectations and judge your own performance much more accurately.

Here are the key drivers:

- Customer Lifetime Value (LTV): Industries with high LTV, like subscription services or high-end B2B software, can afford a much higher initial CPA. They know the long-term payoff is substantial.

- Product or Service Price: It’s simple, really. Businesses selling big-ticket items or services naturally have more wiggle room in their margins to spend on winning each new customer.

- Sales Cycle Length: A complex sale that takes months of nurturing—think enterprise software—will always have a higher CPA than a simple, impulse buy from an eCommerce site.

- Market Competition: When you’re in a crowded market with dozens of businesses bidding on the same keywords and audiences, ad costs skyrocket. This pushes the average CPA up for everyone involved.

A healthy CPA is always relative to your profit margins and customer lifetime value. The goal isn’t just to get a low CPA; it’s to get a profitable CPA that fuels sustainable growth for your specific business.

A Look at Average UK Acquisition Costs

Let’s ground this with some real-world data. Customer Acquisition Cost (CAC), a metric that’s a close cousin to CPA, really shines a light on the spending differences across UK sectors. High-touch B2B industries often face the steepest costs. For instance, sectors like IT and managed services can see average CACs hitting over £240, while specialised legal services might see that figure climb as high as £470 per new customer.

At the other end of the scale, industries like pharmaceuticals report much lower average costs, somewhere around £158. You can find more insights on customer acquisition costs over at GoCustomer.ai.

This data proves that a high CPA isn’t automatically a red flag. For a law firm securing a client worth thousands in fees, that £470 acquisition cost is a perfectly sound investment.

How to Benchmark Your Own CPA

So, how do you figure out where you stand? Instead of chasing some arbitrary low number, your entire focus should be on profitability. Your CPA has to be significantly lower than what a customer is actually worth to your business.

Start by looking inward at your own data. If your campaigns are struggling to deliver a positive return, that’s a massive signal that something needs to change. A thorough audit can reveal exactly where your budget is being wasted and pinpoint opportunities for quick wins.

For a structured approach, using a comprehensive PPC audit checklist helps you systematically analyse your account’s health and find ways to lower your acquisition costs effectively. This whole process allows you to stop comparing your business to irrelevant industry averages and start focusing on what really matters: optimising your unique marketing funnel for maximum profit.

CPA Insights for UK eCommerce Sellers

If you’re a UK eCommerce seller, getting a handle on your Cost Per Acquisition isn’t just another metric to track—it’s absolutely fundamental to staying profitable. In the fast-moving world of online retail, especially on fiercely competitive platforms like Amazon, your CPA can literally make or break your business.

The UK eCommerce market is crowded, and that means you need a sharp focus on how much it costs to win over each new customer. For Amazon sellers in particular, acquisition costs can swing wildly. Some sellers might nail a really low CPA, while others find their costs are so high they chew right through their margins.

This massive variation just goes to show that a solid strategy is non-negotiable. Simply throwing more money at ads isn’t a guaranteed path to success anymore; the real win comes from spending smarter.

The Typical CPA Range for UK Sellers

So, what’s a “normal” CPA for a UK-based Amazon seller? Generally, you can expect it to land somewhere between £15 and £60. It’s a pretty wide range, and where your business falls depends on a handful of key factors.

These variables directly shape how much you need to invest to secure a single sale. Getting to grips with them is the first step toward optimising your ad spend and boosting your return.

What drives this number up or down?

- Product Category: Are you selling in a saturated market like electronics or fashion? Your CPA will almost always be higher than if you’re in a niche, low-competition category.

- Advertising Strategy: A heavy reliance on pay-per-click (PPC) ads without a strong organic presence will naturally push up your acquisition costs.

- Fulfilment Method: Your choice between Fulfilment by Amazon (FBA) and handling it yourself can impact everything from shipping costs to customer experience, which all indirectly feed into your CPA.

For any UK eCommerce seller, diving deep into effective ecommerce PPC marketing strategies provides a playbook for navigating these complexities and driving down those acquisition costs.

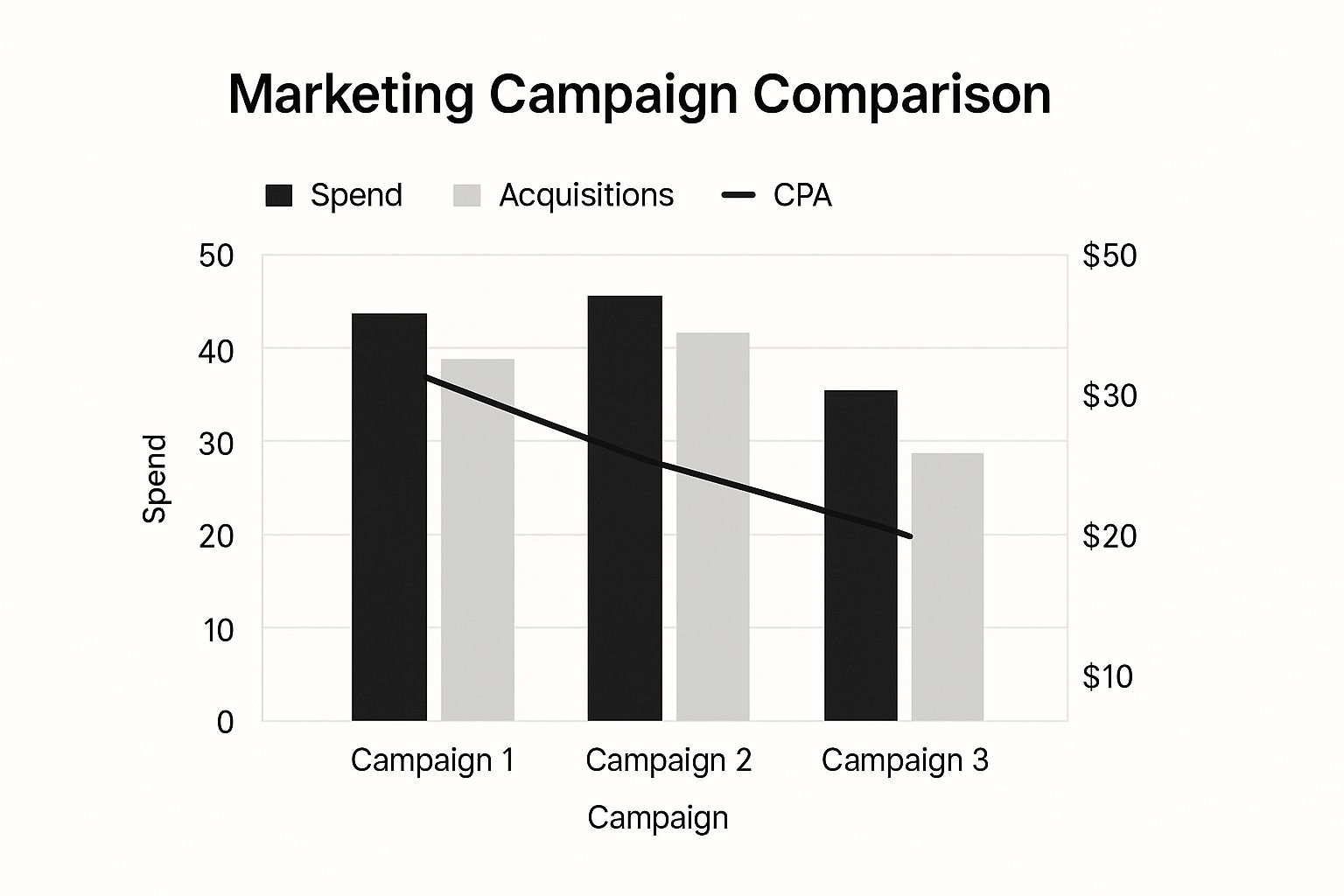

This chart really brings home how different campaign approaches can lead to wildly different CPA outcomes, even with similar budgets.

As you can see, the campaign with the highest spend didn’t actually deliver the lowest CPA. The most efficient campaign was the one that secured more acquisitions for a more moderate spend. Efficiency trumps budget every time.

How Product and Strategy Choices Impact Your CPA

Let’s break down exactly how specific choices can send your CPA soaring or bring it back down to earth. Things like your product’s price point, how well-known your brand is, and the competitive battlefield all play a huge part.

To make this crystal clear, I’ve put together a table contrasting the characteristics that typically lead to a low CPA versus a high one. It’s a useful framework for taking a hard look at your own business.

Factors Influencing CPA for UK eCommerce Sellers

| Factor | Low CPA Scenario | High CPA Scenario |

|---|---|---|

| Competition | You sell a unique product in a niche with few direct competitors. | You operate in a crowded market like fast fashion or consumer electronics. |

| Product Price | Your item is a low-cost, high-volume product that encourages impulse buys. | You sell a high-ticket item that requires a longer consideration phase. |

| Brand Authority | Your brand is well-known and has a strong base of positive customer reviews. | You are a new seller trying to build trust and recognition from scratch. |

| Ad Targeting | Your campaigns are highly targeted to a specific audience with clear buying intent. | You use broad targeting that results in significant wasted ad spend on irrelevant clicks. |

A low CPA is often the result of finding that sweet spot where your product meets a specific demand with minimal competition. On the flip side, a high CPA is a clear sign you’re fighting for attention in a noisy market and need to refine your strategy.

Ultimately, getting your CPA under control is what separates stagnant brands from growing ones. For a comprehensive guide on improving your return on investment, you might find our article on effective PPC management strategies for UK SMEs really useful. It’ll help you turn these insights into concrete, actionable steps for your campaigns.

Actionable Strategies to Lower Your CPA (What Is Cost Per Acquisition?)

Understanding your Cost Per Acquisition is one thing. Knowing how to actively bring it down is where you unlock serious profitability. A high CPA can absolutely drain your budget and stall growth, but a lower, more efficient CPA gives you the power to scale your business sustainably. It’s not just about spending less; it’s about making every pound you spend work much, much harder.

This isn’t about guesswork or crossing your fingers. It’s about putting proven, data-driven tactics into action to systematically improve your campaigns. From sharpening your ad targeting to building landing pages that actually convert, each strategy is a crucial piece of the puzzle in lowering your acquisition costs.

Refine and Sharpen Your Ad Targeting

One of the quickest ways to slash your CPA is to stop wasting money on clicks from people who will never, ever convert. Broad, unfocused ad targeting is a classic mistake that sends costs soaring by showing your ads to completely the wrong audience. The trick is to get granular.

Instead of targeting vague demographics, you need to dig deeper. Use the audience insights from platforms like Google Ads and Meta to build out detailed profiles of your ideal customer. Then, refine your campaigns by targeting specific interests, online behaviours, and even key life events.

Think about these refinements:

- Negative Keywords: Be ruthless with your negative keyword lists. If you sell premium running shoes, you don’t want to pay a penny for clicks from someone searching for “cheap kids’ shoes.” Actively exclude them.

- Lookalike Audiences: Take your list of best existing customers and build lookalike audiences from it. This tells the ad platforms to go out and find new people who share the same characteristics as those who already love and buy from you.

- Geotargeting: Don’t advertise to the entire country if your customers are mainly in Manchester and Liverpool. Narrow your focus to the areas with the highest conversion rates and make your ad spend instantly more efficient.

By tightening up your targeting, you make sure your budget is laser-focused on reaching users with the highest intent to buy. This has a direct, positive impact on lowering your CPA.

What Is Cost Per Acquisition? Optimise Your Landing Page for Conversions

Getting someone to click your ad is only half the battle. If they land on a page that’s confusing, slow, or unconvincing, you’ve just paid for a click that’s going straight into the bin. This is where Conversion Rate Optimisation (CRO) becomes your best friend. A higher conversion rate means more acquisitions from the same ad spend, which instantly drops your CPA.

Think of your landing page as your final, make-or-break sales pitch. It must perfectly match the promise you made in the ad.

Key Insight: A small improvement in your landing page conversion rate can have a massive impact on your CPA. If you double your conversion rate from 2% to 4%, you’ve effectively cut your CPA in half without spending a single extra penny on ads.

Start by making sure your page has one, crystal-clear call-to-action (CTA). Get rid of any distracting navigation links or waffle that could pull the user away from the main goal. Use punchy headlines, great images, and social proof like customer reviews to build trust and push them to take action. You can learn more about turning clicks into customers in our guide on maximising your ROI with Google Pay Per Click advertising strategies.

Invest in Sustainable Organic Channels

What Is Cost Per Acquisition? Paid advertising is great for getting quick results, but it’s an expensive and competitive game. For long-term, sustainable growth and a naturally lower CPA over time, you absolutely have to invest in organic channels. Building a strong organic foundation means you aren’t constantly paying for every single click and customer.

Two of the most powerful organic channels are:

- Search Engine Optimisation (SEO): By optimising your website to rank high in Google for your key terms, you can attract a steady, free-flowing stream of highly qualified traffic. It’s a long game, but the payoff is enormous.

- Content Marketing: Creating genuinely useful blog posts, guides, and videos that solve your audience’s problems builds authority and trust. This content attracts organic traffic and nurtures potential customers, reducing how much you need to lean on paid ads.

While not a direct measure of customer costs, wider acquisition trends in the UK show just how expensive securing growth is becoming. For instance, the value of inward mergers and acquisitions involving UK companies hit £19.2 billion in just the first quarter of this year. Data like this reinforces the need for smart, efficient, organic growth strategies to stay competitive.

Common Questions About Cost Per Acquisition

Even after you get your head around what Cost Per Acquisition is and how to bring it down, the practical questions always start to bubble up. This final part is all about tackling those common, real-world queries that pop up the minute you start applying CPA principles to your own marketing.

Getting these answers right is what turns theory into profitable action. We’ll give you clear, straightforward answers to the questions we hear most often. This will help you set realistic goals, figure out the right review schedule for your campaigns, and adapt this powerful metric for all your business objectives.

What Is a Good CPA for a New Business?

For a brand new business, a “good” CPA is less about hitting some magic industry number and more about one simple thing: sustainability. When you’re just starting out, you have no historical data, so your first goal should be to set a baseline that’s lower than your customer lifetime value (LTV). If a customer is worth £150 to you over their lifetime, then any CPA below that number is technically profitable.

But profitability is just the starting line. A truly good CPA for a new business is one that leaves you enough room to reinvest and actually grow.

A sensible approach is to aim for a 3:1 ratio of LTV to CPA. So, if your LTV is £150, you should be aiming for a CPA of £50 or less. This gives you a healthy margin to cover all your other business costs and, crucially, to fuel your future marketing campaigns.

Key Insight: Don’t get bogged down comparing yourself to established competitors on day one. Focus on your own data. Figure out your LTV, set a sensible CPA target based on that 3:1 ratio, and start optimising towards that goal.

As you gather more data, you can start to refine this target. At the beginning, your focus is purely on learning what works and building a profitable foundation, even if your CPA seems high compared to the rest of the industry.

How Often Should I Calculate My CPA?

How often you crunch your CPA numbers depends entirely on the pace and scale of your marketing. There’s no one-size-fits-all answer here, but you can follow some solid guidelines to stay on top of performance without drowning in data.

- For Active PPC Campaigns: If you’re running daily ad campaigns on platforms like Google or Meta, you should be checking your CPA on a weekly basis. This lets you spot trends, catch underperforming ad groups, and make quick fixes before you burn through your budget.

- For Broader Marketing Efforts: For a more holistic view that includes everything from salaries to software subscriptions, calculating your overall business CPA on a monthly or quarterly basis is much more practical. This gives you a high-level, strategic overview of your marketing efficiency.

Checking in regularly ensures you’re always making decisions based on what’s happening right now. Setting up automated reports in your ad platforms or analytics software can make this almost effortless, giving you the insights you need without the manual slog.

Can I Use CPA for Non-Sales Goals?

Absolutely. While CPA is most often tied to a final sale, its real strength is its flexibility. You can, and should, adapt the “acquisition” part to track any valuable action that moves someone along your marketing funnel. It’s all about defining what an “acquisition” means for that specific campaign’s goal.

This changes CPA from a simple sales metric into a versatile tool for measuring the efficiency of your entire marketing machine. You’re no longer just asking, “What did it cost to get a sale?” You’re also asking, “What did it cost to get a valuable engagement?”

Here are just a few examples of non-sales acquisitions you could track:

- Newsletter Sign-ups: Calculate the cost to get each new email subscriber on your list.

- App Downloads: Work out how much you’re spending for every single user who installs your mobile app.

- Free Trial Registrations: Track the cost to get a potential customer to sign up for a trial of your software.

- Lead Form Submissions: Measure how efficient your B2B campaigns are by calculating the cost per qualified lead.

By assigning a CPA to these top-of-funnel actions, you get a much clearer picture of which channels are best at building your audience and generating future opportunities. This allows you to optimise your budget for a whole range of business-critical outcomes, not just immediate cash in the bank.

Ready to stop guessing and start getting real results from your advertising? The team at PPC Geeks creates data-driven strategies to lower your CPA and maximise your ROI. Get your free, in-depth PPC audit today and discover how much you could be saving.

Author

Search Blog

Free PPC Audit

Subscribe to our Newsletter

The Voices of Our Success: Your Words, Our Pride

Don't just take our word for it. With over 100+ five-star reviews, we let our work-and our satisfied clients-speak for us.

"We have been working with PPC Geeks for around 6 months and have found Mark and the team to be very impressive. Having worked with a few companies in this and similar sectors, I rate PPC Geeks as the strongest I have come across. They have taken time to understand our business, our market and competitors and supported us to devise a strategy to generate business. I value the expertise Mark and his team provide and trust them to make the best recommendations for the long-term."

~ Just Go, Alasdair Anderson