What is Customer Lifetime Value? Boost Your Business Growth

What is Customer Lifetime Value? At its core, Customer Lifetime Value (CLV) is the total predictable revenue a business can expect from a single customer over the entire time they do business with you. It’s a shift in thinking. We’re not just looking at a single purchase, but at the full story of every future transaction that customer makes.

This single metric moves your focus from chasing short-term sales to building long-term, sustainable growth.

A Simple Way to Think About Customer Lifetime Value (What is Customer Lifetime Value?)

Let’s imagine your business is a local coffee shop. A new customer walks in and buys a £3 latte. That’s their initial value. But what’s their lifetime value?

If that person loves your coffee and comes back every weekday for the next year, their value isn’t just that initial £3. It’s a steady, predictable stream of income. CLV forces you to ask a much bigger question: what is the total worth of that customer’s loyalty over time?

Suddenly, you start seeing customers not as one-off sales, but as ongoing relationships with real financial potential. This perspective is a game-changer, especially for shaping your marketing and customer service.

The Three Pillars of Customer Lifetime Value: What is Customer Lifetime Value?

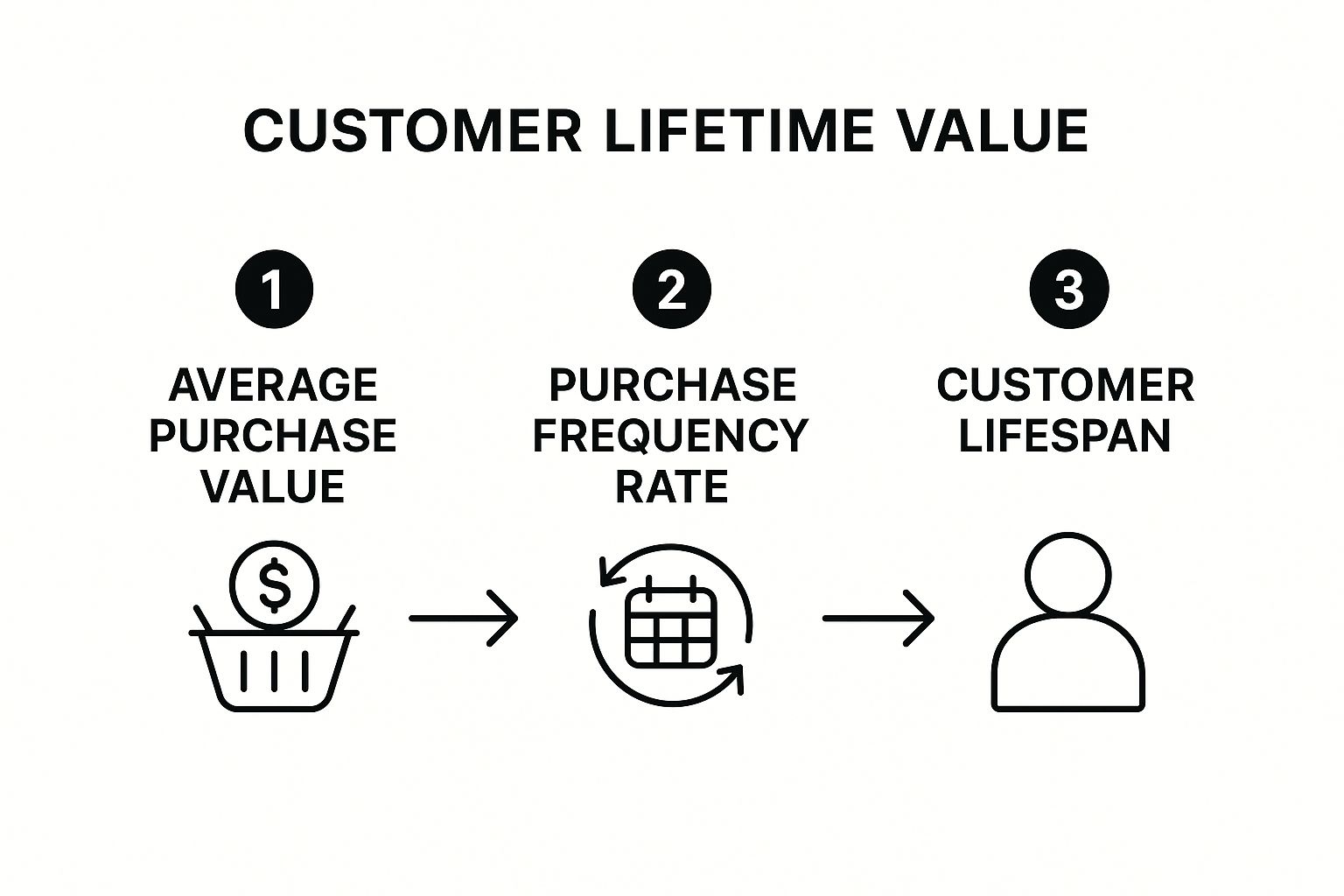

At its heart, CLV is built on three key factors. Once you understand these pillars, the whole concept becomes much clearer, and you can see exactly where you can make an impact.

We can break down these core components into a simple table:

| Pillar | What It Measures | Its Role in CLV |

|---|---|---|

| Average Spend | The typical amount a customer spends in one transaction. | A higher average spend directly increases the value of each purchase. |

| Purchase Frequency | How often the customer comes back to buy something. | More frequent purchases mean more revenue over a shorter period. |

| Customer Lifespan | The total length of time the customer stays with your brand. | A longer relationship means more opportunities for repeat business. |

By focusing on improving these three elements, you move beyond just acquiring new customers. Instead, you start strategising on how to make every single relationship you build more valuable. That’s the foundation of a CLV-driven business.

Key Takeaway: Shifting from a transactional mindset to a relational one is fundamental. The goal isn’t just to make a sale; it’s to create a loyal customer who returns again and again, multiplying their value over time.

This isn’t just theory; the data backs it up. For businesses in the UK, loyal customers are the bedrock of profitability. A returning customer spends five times more than a first-time buyer, highlighting the huge financial upside of nurturing long-term relationships.

But building that loyalty takes time. In fact, 37% of UK consumers say it takes five or more purchases before they even consider themselves committed to a brand. You can explore more fascinating customer loyalty statistics over on BloggingWizard.com.

The Strategic Advantage of Focusing on CLV

In a market this competitive, simply knowing what customer lifetime value is isn’t enough—making it central to your strategy is essential for any kind of sustainable growth. When you shift your focus to CLV, everything changes. It moves from being just another metric to becoming the strategic compass for your entire business, influencing everything from marketing budgets to product development.

Let’s imagine two online retailers. The first is obsessed with one thing: the lowest possible cost per acquisition (CPA). They blast out broad campaigns, pulling in loads of one-time buyers who grab a discount and are never seen again. Sure, their CPA looks great on paper, but their business is just a revolving door of low-value sales.

The second retailer gets it. They understand CLV. They’ve realised that the customers they acquire through their blog content tend to spend more and stick around for years. The initial cost to get these customers might be higher, but their lifetime value is through the roof. This insight gives them the confidence to invest more heavily in content marketing, knowing the long-term payoff more than justifies the initial spend.

This is the heart of the matter: CLV gives you the confidence to invest strategically for long-term profitability, instead of chasing cheap, short-term wins that don’t build a real business.

From Budgeting to Business Intelligence

Knowing the lifetime value of different customer segments completely transforms how you make decisions. You move from guesswork and gut feelings to data-backed strategy, and it has a ripple effect across the entire organisation.

- Smarter Marketing Spend: You can finally allocate your budget where it really counts, investing in channels that bring in customers with the highest long-term value, not just the lowest upfront cost.

- Improved Profitability: By focusing on keeping and nurturing your high-value customers, you boost revenue from your existing base. In fact, research shows that increasing customer retention by just 5% can skyrocket profits by 25% to 95%.

- Enhanced Customer Retention: When you know which customers are your most valuable, you can go the extra mile to look after them. This builds powerful loyalty and stops them from churning.

At its core, focusing on CLV forges a direct link between your marketing activities and your long-term financial health. It ensures every pound you spend on acquiring a customer is an investment in future, predictable revenue.

This philosophy is fast becoming a cornerstone for success, particularly in the UK’s evolving retail space. As retailers pivot from a “growth at all costs” mindset to one focused on profitable, lasting relationships, they’re using CLV to guide their every move. Many now use sophisticated tools to track consumer behaviour and personalise interactions, which directly feeds into a higher lifetime value. You can dig deeper into how UK retailers are using CLV for growth in this in-depth commerce report.

Connecting CLV to Campaign Success

In the world of paid advertising, CLV is an absolute powerhouse. A campaign that looks like a dud when judged by its immediate return on ad spend (ROAS) might actually be your most valuable channel when you look at it through the CLV lens.

For example, a Google Ads campaign might have a higher CPA than your latest social media campaign. But what if the customers coming from Google Ads have a CLV that’s three times higher? Suddenly, you know exactly where your investment is truly paying off. This insight allows you to optimise your bids and budgets for long-term profit, not just the first sale. Our guide on mastering ROI in paid advertising explores this in much more detail.

Ultimately, if you ignore CLV, you could be actively turning away your best future customers in favour of cheap, fleeting wins. Embracing it, on the other hand, empowers you to build a resilient, profitable business by strategically nurturing the relationships that matter most.

How to Calculate Customer Lifetime Value Accurately

Understanding the what and why of customer lifetime value is one thing, but turning that concept into a hard number for your business is where the real power lies. Actually calculating CLV moves it from a fuzzy idea to a solid metric you can build a strategy around.

The good news? You don’t need a degree in data science to get started. By breaking the calculation down into a few manageable steps, you can get a clear picture of what your customers are really worth. It all starts with grabbing a few key pieces of data from your sales or CRM systems.

Starting with the Simple CLV Formula

The most straightforward way to work out CLV is to focus on three core metrics: how much customers spend, how often they come back, and how long they stick around. This approach gives you a quick, revenue-focused snapshot of customer value.

Here’s what the formula looks like:

CLV = Average Purchase Value x Average Purchase Frequency x Average Customer Lifespan

Let’s unpack each part so you know exactly what numbers you need to find.

This infographic lays out the three key steps involved in the calculation.

As you can see, calculating CLV is a simple process where each metric builds on the last to create a complete picture of what a customer is worth to you.

Putting the Simple Formula into Practice

To make this crystal clear, let’s walk through an example. Imagine you run “The BritBox,” a subscription service delivering British snack boxes for a monthly fee.

- Calculate Average Purchase Value: You look at your total revenue over the last year (£50,000) and divide it by the total number of orders (2,000). That gives you an average purchase value of £25.

- Calculate Average Purchase Frequency: You see that your 500 unique customers made those 2,000 orders. This means each customer made an average of 4 purchases per year.

- Calculate Average Customer Lifespan: Digging into your data, you discover that, on average, customers stay subscribed for 3 years.

Now, you just multiply these figures together:

CLV = £25 (Average Purchase Value) x 4 (Purchases Per Year) x 3 (Years)

This gives you a historic CLV of £300. What does this mean? On average, every new customer you bring in is projected to generate £300 in revenue over their entire relationship with your business. For a more detailed walkthrough, this guide offers an excellent breakdown of how to calculate customer lifetime value.

Advancing to a More Precise Calculation

The simple formula is a brilliant starting point, but it has one big limitation: it’s all about revenue, not profit. To get a truer sense of a customer’s worth to your bottom line, you absolutely must factor in your profit margin.

A more advanced formula brings this crucial element into play:

CLV = (Average Purchase Value x Average Purchase Frequency x Average Customer Lifespan) x Profit Margin

Let’s go back to our BritBox example. You know your profit margin on each box is 40% (or 0.4). You can now apply this to your previous calculation.

CLV = £300 (Historic CLV) x 0.40 (Profit Margin)

Your profitability-focused CLV is £120. This figure is far more useful for making smart decisions about your marketing budget and where to put your resources. It tells you that for every customer you sign up, you can expect to make £120 in actual profit.

By focusing on profit instead of just revenue, you can make smarter, more sustainable decisions. It prevents you from overspending to acquire customers who might generate high revenue but offer very low profitability.

This distinction is vital for any business, especially when you’re managing PPC budgets where every pound counts. Understanding your profitable CLV helps you set realistic customer acquisition cost (CAC) targets and ensures your campaigns are contributing directly to growth. If you’re looking to apply these principles, PPC Geeks offers an in-depth exploration of how to calculate customer lifetime value specifically for campaign optimisation. Knowing these numbers is the first step toward building a more resilient and profitable business model.

The Emotional Drivers That Supercharge CLV

While the formulas and spreadsheets give you the “what” of customer lifetime value, they miss the “why.” A high CLV isn’t just about transactions. It’s forged in something much more powerful: an emotional connection. The numbers can tell you how much a customer spends, but they can’t capture the trust and loyalty that keep them coming back for more.

Real, sustainable CLV growth comes from genuine relationships, not just one-off marketing campaigns. When a customer feels seen, heard, and genuinely valued, they’ll stick with you – even when a competitor dangles a slightly lower price. This bond is the secret sauce that turns a casual buyer into a passionate advocate for your brand.

What is Customer Lifetime Value? The Tale of Two Customers

To really see what I mean, let’s paint a picture of two very different buyers.

First, you have the Convenience Buyer. This person shops with you because it’s easy. They might like your product, sure, but their loyalty is wafer-thin and purely transactional. The moment a rival offers a better deal or a more convenient option, they’re gone. Their CLV has a ceiling, dictated entirely by circumstance.

Then, you have the Brand Advocate. This customer doesn’t just buy from you; they believe in you. They feel a sense of belonging, a real connection built on consistently great experiences, top-notch service, and the feeling that your brand gets them.

A Brand Advocate’s loyalty isn’t about saving a few quid. It’s about how you make them feel. They’ll forgive a minor hiccup, rave about you to their mates, and even jump to your defence online. Their CLV potential is massive because the relationship is built on a solid emotional foundation.

Building Unbreakable Bonds

So, how do you actually cultivate these powerful connections? It all starts by looking past the simple metrics and zeroing in on the entire customer experience. That rock-solid bond is the sum of countless small, positive interactions over time.

This isn’t just some fluffy, feel-good idea; it has a direct, measurable impact on your bottom line. Yet, so many brands in the UK are dropping the ball. Research shows a staggering 83% of UK consumers feel undervalued by the brands they’re loyal to. Despite this, the same study found a 26% increase in ‘True Loyalty’—the deep, trust-based kind—between 2021 and 2024. You can read more about these findings in this MarketingTechNews.net report.

This gap highlights a massive opportunity for businesses ready to invest in real relationships. It’s about proving you care through your actions, not just your advertising slogans.

Key Takeaway: Emotionally connected customers are the engine of sustainable growth. Their loyalty is more resilient, they spend more over their lifetime, and they become a voluntary marketing force for your brand.

Getting this right means truly understanding what makes your customers tick. You need to listen to their feedback, personalise their journey, and deliver exceptional service, time and time again. All of this is underpinned by tracking the right data. Understanding the key performance indicators for digital marketing is vital for measuring how your relationship-building efforts are actually moving the needle. At the end of the day, the brands that win are the ones that make their customers feel like they’re part of something special.

Actionable Strategies to Boost Your Customer Lifetime Value

Right, so you understand what customer lifetime value is and you’ve even crunched the numbers. That’s a massive first step. But the real value comes from what you do next. Improving your CLV isn’t about finding a single magic bullet; it’s about making a series of smart, deliberate improvements across the entire customer journey.

By focusing on tried-and-tested tactics, you can get customers to stick around longer, buy more often, and ultimately, make your business more profitable in the long run. Here’s a practical toolkit of strategies you can put into action today.

Perfect Your Customer Onboarding Process

Those first few interactions a new customer has with your brand are absolutely critical. A smooth, welcoming, and genuinely helpful onboarding experience sets the tone for a long and fruitful relationship. If you get it wrong, you risk them walking away before they’ve even had a chance to see what you’re really about.

Think of it like the first chapter of a book. If it’s confusing or just plain boring, no one’s going to hang around for chapter two. Your mission is to get that customer to their “aha!” moment—that point where they truly get how your product or service makes their life better—as quickly as you can.

Here are a few ways to nail your onboarding:

- Create a Welcome Email Sequence: Don’t just fire off a single order confirmation and call it a day. Build a series of emails that introduces your brand story, shares useful tips, highlights popular products, and makes the customer feel like they’ve joined a community.

- Offer Clear Instructions and Support: Whether it’s a “quick start” guide for a product or an in-app tutorial for a service, make it incredibly simple for customers to get going and find help when they need it.

- Personalise the Welcome: Use the data you have—like their first purchase—to make the onboarding feel personal. If they bought running shoes, send them content about local running routes or training plans.

Implement a Meaningful Loyalty Programme

A well-designed loyalty programme is a classic for a reason: it works. It’s a brilliant way to increase how often customers buy and how long they stay with you. You’re directly rewarding the exact behaviour you want to see—loyalty and repeat business.

But just be aware, a generic “earn one point for every pound spent” system might not cut it anymore. The best loyalty programmes feel exclusive and offer real value that goes far beyond simple discounts.

A loyalty programme shouldn’t just be a transaction machine. It should be a vehicle for making your best customers feel recognised, appreciated, and special. This emotional connection is what truly drives long-term loyalty and higher CLV.

Think about these approaches to make your programme stand out:

- Tiered Rewards: Set up different levels (e.g., Bronze, Silver, Gold) that customers can climb by spending more. Higher tiers should unlock increasingly tempting perks like free shipping, early access to new products, or invitations to exclusive events.

- Experiential Rewards: Go beyond money-off vouchers. Offer rewards your competitors can’t just copy, like a one-on-one consultation, a free gift on their birthday, or access to a VIP customer service line.

- Non-Transactional Engagement: Reward customers for more than just opening their wallets. Give them points for writing a review, following you on social media, or referring a friend. This deepens their connection to your brand.

What is Customer Lifetime Value? Master the Art of the Upsell and Cross-Sell

One of the fastest ways to give your CLV a serious boost is by increasing your average order value. By strategically offering relevant upsells (a more premium version of the product) and cross-sells (complementary items), you can increase the value of every single transaction.

The key here is to be helpful, not pushy. Your recommendations should feel like you’re genuinely trying to improve the customer’s experience. For example, if someone is buying a high-end camera, suggesting a compatible lens (a cross-sell) or a protective case is a valuable service, not just a slimy sales tactic.

Comparing Strategies to Boost Your CLV

Choosing where to focus your efforts can be tough. The table below breaks down the strategies we’ve discussed, giving you a clearer picture of their impact, how much work is involved, and the kind of uplift you might see in your CLV.

| Strategy | Primary Impact Area | Implementation Effort | Potential CLV Uplift |

|---|---|---|---|

| Customer Onboarding | Early Retention & Engagement | Medium | Medium to High |

| Loyalty Programme | Purchase Frequency & Retention | Medium to High | High |

| Upselling & Cross-selling | Average Order Value | Low to Medium | Medium |

| Personalisation | Engagement & Conversion Rate | Medium | High |

| Feedback Collection | Customer Satisfaction & Retention | Low to Medium | Medium |

This should help you prioritise. While a full-blown loyalty programme might promise the biggest gains, a simpler focus on upselling or improving your welcome emails could deliver a quicker win with less effort.

Personalise Your Marketing Communications

Today’s customers don’t just want personalisation; they expect it. Blasting your entire email list with the same generic offer is a fast track to the unsubscribe button. Personalisation, on the other hand, shows you’re paying attention and makes your customers feel seen and understood.

Use the data you have to slice your audience into segments and send them messages that are actually relevant. For example:

- Segment by Past Purchase History: Send customers who bought hiking boots promotions for waterproof jackets, not evening dresses.

- Segment by Engagement Level: Reward your most active customers with exclusive deals, and run re-engagement campaigns for those who’ve gone quiet.

- Leverage Behavioural Triggers: Set up automated emails for specific actions, like abandoning a shopping basket or viewing a certain product multiple times.

This level of personalisation has a direct knock-on effect on your PPC campaigns. Once you know which customer segments have the highest CLV, you can build more targeted and profitable campaigns around them. If you want to dive deeper, our guide on how to improve Google Ads performance explores how to align your strategy with these high-value audiences.

Actively Seek and Act on Customer Feedback

Your customers are a goldmine of information about how to make your business better. Actively asking for their feedback—and, crucially, acting on what they tell you—shows you respect their opinion and are committed to improving.

This builds an incredible amount of trust and can turn a slightly unhappy customer into a lifelong fan. Use surveys, reviews, and even just direct conversations to figure out what you’re doing well and where you’re falling short. And when you do make a change based on that feedback, tell your customers about it. This closes the loop, proves you were listening, and cements their loyalty and lifetime value.

Common Questions About Customer Lifetime Value

Even when you’ve got a decent handle on customer lifetime value, it’s completely normal to have questions about how it all works in the real world. This metric is the bridge between your big-picture strategy and your day-to-day decisions, so getting the details right is vital.

So, let’s dive into the most common questions we hear from business owners and marketers about CLV. The goal here is to give you clear, straight-up answers so you can use this metric with confidence and dodge the usual mistakes.

What Is a Good Customer Lifetime Value?

This is probably the question we get asked most, and the answer is refreshingly simple: there is no universal “good” CLV. The number is entirely down to your industry, business model, and what you’re selling. A brilliant CLV for a local coffee shop would look tiny next to a strong one for a B2B software company.

Instead of chasing some magic number, you should be focused on the ratio of your CLV to your Customer Acquisition Cost (CAC). This is what really tells the story of how much value you’re generating for every pound you spend to land a new customer.

A healthy CLV to CAC ratio is generally seen as 3:1 or higher. In plain English, for every £1 you spend getting a customer, you should be making at least £3 back over their lifetime. Focusing on this ratio gives you a much better sense of your business’s health than any standalone CLV figure ever could.

Your main goal should be to keep pushing your CLV up over time while making sure your acquisition costs stay profitable.

What is Customer Lifetime Value? How Does CLV Affect Digital Advertising Strategy?

Understanding CLV completely changes how you look at digital advertising, especially in paid search and social campaigns. It shifts your whole mindset from chasing short-term wins to building long-term, sustainable profit.

Without CLV, you’re probably optimising your campaigns for the lowest possible cost-per-acquisition (CPA) on that first sale. This can be dangerously shortsighted. A campaign that brings in a low initial CPA might just be attracting low-value, one-and-done buyers who never come back.

When you know your CLV, you can start setting higher, more strategic acquisition bids. If you know that customers from a particular Google Ads campaign have a high lifetime value, you can comfortably afford to pay more to get them. This lets you outbid competitors who are stuck focusing only on that first, low-margin sale.

Here’s how it looks in practice:

- Find Your Best Channels: Analyse your CLV by acquisition source (e.g., Google Ads, organic search, Facebook) to see which channels are actually delivering your most profitable long-term customers.

- Go All-In on Top Audiences: By segmenting your CLV data, you can pinpoint the exact audiences and demographics that are most valuable and put more of your budget into reaching them.

- Justify Higher Upfront Costs: It gives you the confidence to invest in campaigns that might look expensive at first glance but will pay for themselves many times over.

In the end, CLV gives you permission to play the long game, attracting and keeping the kind of customers that will fuel real, sustainable growth.

What Are the Most Common Mistakes When Calculating CLV?

Getting the calculation right is everything—mess it up, and you could be making some seriously bad business decisions. A few common slip-ups can completely throw your numbers off and lead you down the wrong path.

One of the biggest mistakes is using revenue instead of profit margin. A high-revenue customer isn’t always a profitable one. If you base your CLV on gross revenue, you can massively inflate the figure, which might lead you to overspend on acquisition and make poor strategic calls.

Another huge error is failing to segment your customers. Just calculating a single, business-wide average CLV hides all the juicy details. Your most valuable customers get lost in the mix with the least valuable ones, and you miss the real story. You have to calculate CLV for different segments—like by acquisition channel, first product bought, or demographic—to find out who your true VIPs are.

Finally, a lot of people see CLV as a static, one-and-done calculation. That’s a mistake. It’s a living, breathing metric that you need to track over time. Recalculating it regularly shows you the real impact of your marketing and retention efforts.

What Tools Can Help Calculate and Track CLV?

While you can definitely wrestle with spreadsheets to calculate CLV, there are plenty of tools out there that can automate the whole process and give you much deeper insights.

- CRM Platforms: Systems like HubSpot and Salesforce are often where all your customer data lives. They can track everything you need—like purchase history and customer lifespan—and many have built-in reporting to help you analyse CLV.

- E-commerce Platforms: Solutions such as Shopify and BigCommerce have a massive ecosystem of apps and integrations built specifically for CLV analysis. These tools can pull sales data straight from your store to create powerful reports.

- Business Intelligence (BI) Tools: For more advanced, predictive stuff, BI platforms like Tableau or Looker can connect to all your different data sources. They let you build fancy, customised CLV dashboards and run detailed forecasts.

- Specialised Analytics Platforms: There are also dedicated platforms like Glew.io or ChartMogul (especially great for subscription businesses) that are designed from the ground up to calculate and track CLV and other key e-commerce metrics.

The right tool really depends on how complex your business is and the resources you have. But using technology can make tracking this vital metric far more efficient and, most importantly, actionable.

Feeling a bit snowed under by all the data? The team at PPC Geeks specialises in turning complex metrics like CLV into actionable PPC strategies that drive real growth. Let us handle the numbers so you can focus on your business. Get a free, in-depth PPC audit and discover how we can maximise your long-term profitability. Learn more at PPC Geeks.

Author

Search Blog

Free PPC Audit

Subscribe to our Newsletter

The Voices of Our Success: Your Words, Our Pride

Don't just take our word for it. With over 100+ five-star reviews, we let our work-and our satisfied clients-speak for us.

"We have been working with PPC Geeks for around 6 months and have found Mark and the team to be very impressive. Having worked with a few companies in this and similar sectors, I rate PPC Geeks as the strongest I have come across. They have taken time to understand our business, our market and competitors and supported us to devise a strategy to generate business. I value the expertise Mark and his team provide and trust them to make the best recommendations for the long-term."

~ Just Go, Alasdair Anderson