How to Calculate Customer Lifetime Value Quickly & Easily

To calculate customer lifetime value, you essentially multiply the average value of a customer by their average lifespan with your brand. This core metric is absolutely essential for sustainable growth, as it shifts your focus from chasing one-off sales to building genuinely profitable, long-term relationships.

Why Customer Lifetime Value Is a Game Changer

It’s time to stop focusing only on the next sale. While acquiring new customers always feels like a win, the real key to long-term profitability lies in understanding who your best customers are and doing whatever it takes to keep them happy. This is where Customer Lifetime Value (CLV) becomes your most powerful strategic tool.

CLV represents the total revenue you can reasonably expect from a single customer throughout their entire relationship with your business. It forces you to look beyond short-term acquisition costs and gain a much clearer, more insightful view of long-term profitability.

The True Value of a Customer (How to Calculate Customer Lifetime Value)

Let’s run a quick scenario. Imagine two customers. Customer A makes an impressive one-time purchase of £500 but is never seen again. Meanwhile, Customer B spends a modest £50 every single month for three years.

On the surface, that initial £500 order from Customer A looks fantastic. But a quick calculation shows Customer B’s total value is actually £1,800 (£50 x 36 months).

This simple example highlights a fundamental truth we see every day in business: repeat custom from loyal clients is the bedrock of sustainable growth. Customer B is clearly far more valuable, but without calculating CLV, you might mistakenly pour your marketing budget into finding more “Customer A” types.

CLV isn’t just another metric to track; it’s a strategic mindset. It forces you to ask the right questions about your business, like: “Which customers should we really be investing in retaining?” and “How can we improve our customer experience to build that loyalty?”

Understanding CLV transforms how you approach every part of your business, from your marketing spend and PPC campaigns to product development. It gives you a clear, data-driven path to making smarter decisions that cultivate loyalty and, ultimately, drive profit.

The Bottom-Line Impact of Retention

The financial argument for focusing on CLV is incredibly compelling. Many UK companies know it’s important, yet a surprising number fail to measure it properly. Even though 89% of businesses agree that CLV is vital for building brand loyalty, only 42% feel they can actually measure it accurately. This gap presents a massive opportunity for those who get it right.

The data speaks for itself—even small improvements in retention can yield huge returns. A tiny 5% increase in customer retention can boost profitability by at least 25%, with some studies reporting profit spikes as high as 95%. These figures really hammer home why shifting from an acquisition-only focus to a retention-led strategy is a genuine game changer. You can discover more about these customer lifetime value statistics and their impact on loyalty.

By the end of this guide, you won’t see CLV as some complex formula reserved for data analysts. You’ll see it for what it is: your core strategy for building a more resilient, profitable, and truly customer-centric business.

How to Calculate Customer Lifetime Value: Choosing Your CLV Calculation Method

When you decide to calculate customer lifetime value, one of the first things you’ll realise is that there’s no single, one-size-fits-all formula. The right method for your business depends entirely on your goals, how much data you have, and the resources you can throw at it. The two main models you’ll come across are historical and predictive CLV.

Think of it this way: each model answers a different question. Historical CLV looks backwards to tell you what a customer has been worth based on their past spending. On the other hand, predictive CLV looks forwards, using data to forecast what a customer will be worth in the future.

Picking the right path is a big deal, as it shapes the data you’ll need and the strategic moves you can make off the back of your findings.

Getting Started with Historical CLV

For businesses just dipping their toes into the world of CLV, the historical model is the perfect starting point. It’s wonderfully straightforward, relies on data you probably already have in your sales records, and gives you a solid baseline for understanding customer value.

The calculation itself is direct and doesn’t require fancy statistical software. You’re simply adding up the gross revenue you’ve made from a customer to date.

This screenshot shows exactly how a company might visualise this data – it’s a typical output from a historical CLV analysis, grouping customers by the value they’ve generated.

What this chart highlights so well is a classic business reality: a small group of customers often drives a massive chunk of your revenue. Unlocking this kind of insight is precisely what historical CLV is great for.

Key takeaway: The real strength of historical CLV lies in its simplicity. It provides a tangible, backward-looking number representing the total revenue a customer has brought in. This makes it ideal for initial segmentation and spotting your past top-performers.

But it has a major weakness: it assumes the future will be a carbon copy of the past. It can’t warn you about a loyal customer who’s about to churn, nor can it flag a new customer showing all the early signs of becoming a future VIP. It’s a snapshot in time, not a crystal ball.

Moving to Predictive CLV for Future Growth (How to Calculate Customer Lifetime Value)

This is where things get more advanced—and a lot more powerful. Instead of just tallying up past purchases, predictive CLV uses forecasting techniques (often powered by machine learning) to estimate a customer’s future spending habits.

This approach goes way beyond simple purchase history to analyse a much richer set of data.

Data points often fed into predictive models include:

- Transactional Data: How often they buy, their average spend, and how recently they made a purchase.

- Behavioural Cues: Website browsing patterns, email engagement like opens and clicks, and whether they leave product reviews.

- Demographic Information: Customer age, location, and other relevant profile details.

By analysing these combined signals, predictive models can forecast future revenue much more accurately. They can spot customers with high growth potential, even if their spending so far has been modest. This forward-looking insight is gold for proactive marketing.

For instance, if you identify a segment of customers with a high predicted CLV, you can tweak your PPC bidding strategies to find and acquire more people who fit that exact profile, seriously maximising your return on ad spend.

While setting up predictive models is definitely more complex—you might need specialist skills or software—the payoff is huge. You get the power to spot at-risk customers before they leave, tailor marketing to individual future potential, and make far more accurate revenue forecasts.

Which Model Is Right for You?

So, how do you choose? The decision between historical and predictive CLV really boils down to your current business needs and what you’re capable of handling right now.

| Aspect | Historical CLV | Predictive CLV |

|---|---|---|

| Focus | Backward-looking (past value) | Forward-looking (future value) |

| Complexity | Low (simple formula) | High (requires statistical models) |

| Data Needed | Basic transaction history | Rich data (transactions, behaviour) |

| Best For | New businesses, initial analysis | Mature businesses, proactive marketing |

Ultimately, most businesses start with historical CLV to build that foundational understanding. Then, as their data capabilities and strategic ambitions grow, they make the leap to predictive models to unlock the deeper, more actionable insights needed for long-term growth.

How to Calculate Customer Lifetime Value: Calculating Historical CLV with a Real-World Example

Theory is one thing, but the real magic happens when you roll up your sleeves and start crunching the numbers yourself. To show you exactly how historical Customer Lifetime Value works, let’s step away from the abstract and dive into a practical, real-world scenario.

Imagine a fictional UK-based e-commerce store we’ll call ‘The Manchester Coffee Roasters’. They sell speciality coffee beans and brewing gear directly to coffee lovers. Having been around for a few years, they’ve built up a decent pile of sales data, making them the perfect candidate for a historical CLV calculation.

Our mission is to figure out the average value a customer brings to their business over their entire relationship. To get there, we need to pull three key metrics from their sales history.

Finding the Average Purchase Value

The first piece of the puzzle is the Average Purchase Value (APV). This tells us, on average, how much a customer spends each time they place an order. It’s the foundation of the whole calculation.

For The Manchester Coffee Roasters, we’ll look at their sales over the last 12 months.

- Total Revenue (last 12 months): £120,000

- Total Number of Orders (last 12 months): 4,000

The formula is nice and simple:

Total Revenue / Total Number of Orders = Average Purchase Value

Plugging in the numbers for our coffee shop:

£120,000 / 4,000 orders = £30 APV

So, the typical order at The Manchester Coffee Roasters comes to £30. That’s probably a couple of bags of their signature espresso blend, or maybe one bag and a small accessory.

Determining the Average Purchase Frequency

Next up, we need to know how often the average customer comes back for more. This is the Average Purchase Frequency (APF). A high frequency rate is a fantastic sign of customer loyalty and a massive driver of a healthy CLV.

To find this, we need two different figures from that same 12-month period.

- Total Number of Orders: 4,000

- Total Number of Unique Customers: 1,000

Here’s the formula:

Total Number of Orders / Total Number of Unique Customers = Average Purchase Frequency

Let’s do the maths for our roasters:

4,000 orders / 1,000 unique customers = 4 APF

This tells us the average customer places four orders with The Manchester Coffee Roasters each year. For a coffee enthusiast needing a top-up every quarter, that sounds about right.

Expert Tip: Be careful not to let one-time buyers muddy your data. When calculating purchase frequency, it’s often a good idea to exclude customers who only made a single purchase. This gives you a much clearer picture of the buying habits of your repeat customer base.

Estimating the Average Customer Lifespan (How to Calculate Customer Lifetime Value)

The final ingredient we need is the Average Customer Lifespan (ACL). This metric estimates how long a customer stays active before they stop buying from you (also known as ‘churning’). Honestly, this is often the trickiest one to pin down, especially for newer businesses.

A common way to get a solid estimate is by using your churn rate. Let’s say The Manchester Coffee Roasters has worked out their customer churn rate is 25% per year.

The formula to estimate lifespan from churn is:

1 / Customer Churn Rate = Average Customer Lifespan

So, for our example:

1 / 0.25 = 4 years

This suggests the average customer sticks with The Manchester Coffee Roasters for four years before moving on. This figure is critical because it defines the timeframe over which we’ll measure their total value.

Putting It All Together: The CLV Formula

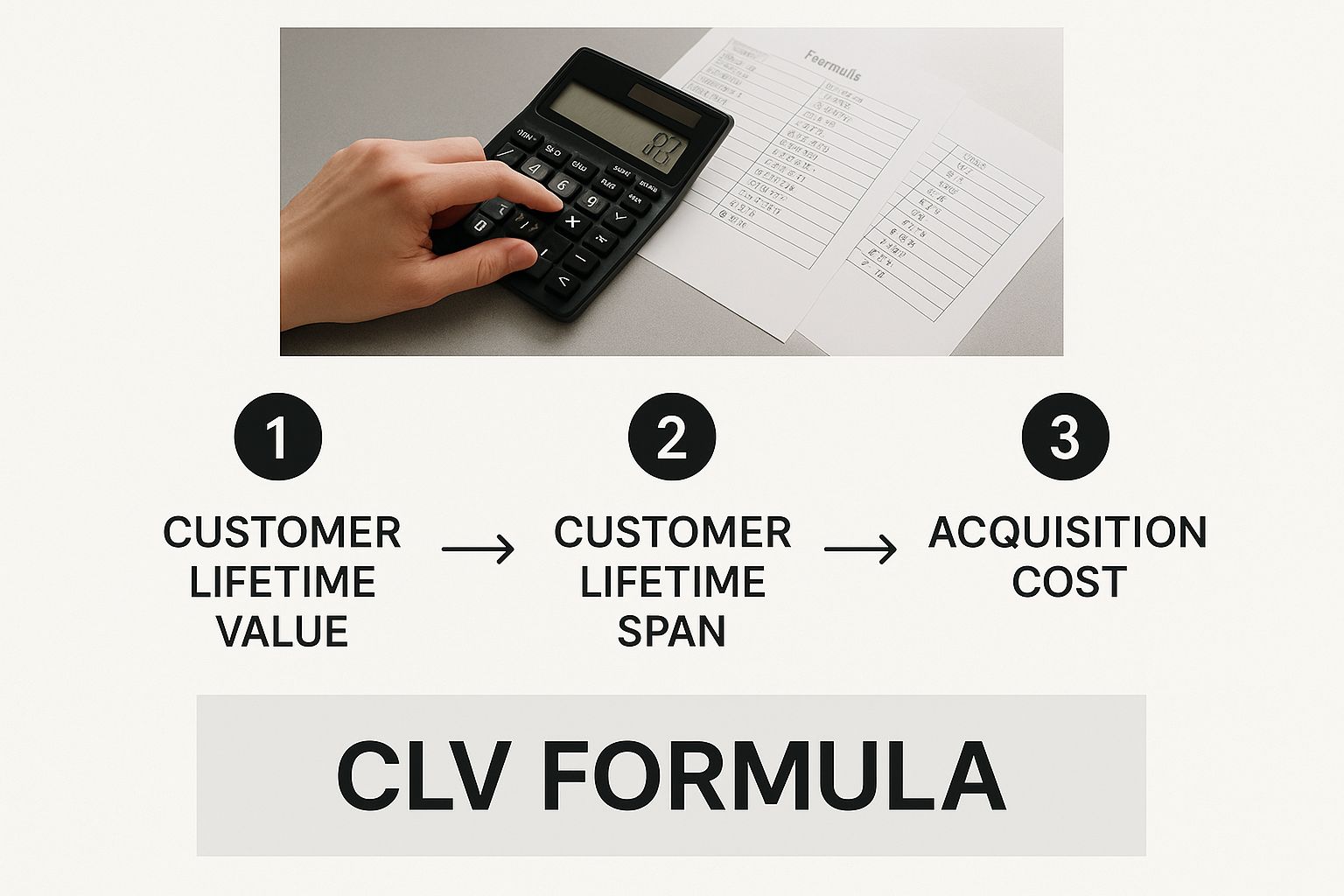

Right, we have all three components. It’s time to bring them together to get our final CLV. This infographic does a great job of showing how these simple numbers combine to create a seriously powerful metric.

As the image shows, CLV is simply the product of these core business metrics you’ve just calculated.

The complete formula for historical CLV looks like this:

Average Purchase Value x Average Purchase Frequency x Average Customer Lifespan = Customer Lifetime Value

Let’s calculate it for The Manchester Coffee Roasters:

£30 (APV) x 4 (APF) x 4 (ACL) = £480

And there we have it. The average customer is worth £480 in revenue to The Manchester Coffee Roasters over their lifetime. This isn’t just a vanity metric; it’s a strategic benchmark. It dictates how much they can afford to spend on marketing to acquire a new customer, which channels are delivering the best return, and how much even a tiny improvement in customer retention could boost their bottom line.

How to Calculate Customer Lifetime Value: Using Advanced CLV for Strategic Growth

Right, so you’ve got your head around calculating customer lifetime value. That’s a solid start, but the real magic happens next. A single CLV number is interesting, sure, but its true power is unleashed when you start using it to segment customers, personalise your marketing, and steer your long-term business strategy.

This is where we move from simply measuring CLV to actively growing it. Think of it less as a static report and more as a dynamic tool. It helps answer those critical questions we all ask: “Where should we really be focusing our marketing budget for the best return?” and “Which customers should we be rolling out the red carpet for?”

Harnessing The Power Of Cohort Analysis

A fantastic way to add some serious depth to your CLV work is through cohort analysis. Instead of just looking at one big, blended average for all your customers, this method groups customers acquired during the same period—like a specific month, quarter, or even during a particular marketing campaign.

For instance, you could analyse the CLV of customers you picked up during a big Black Friday sale and pit it against those acquired through a January PPC campaign. This is how you discover which channels or promotions are bringing in the most valuable customers over the long haul, not just who spent the most on day one. It’s a game-changer.

Smart Segmentation Based On CLV

Let’s be honest: not all customers are created equal when it comes to value. Using CLV to segment your audience lets you tailor your marketing with pinpoint precision. By categorising customers into different value tiers, you can allocate your time, energy, and budget much more effectively.

Imagine creating distinct groups based on their calculated or predicted CLV. This allows you to craft hyper-relevant offers and messages for each segment, from your most loyal brand advocates down to those who might be at risk of churning.

Key Insight: CLV segmentation isn’t about ignoring your lower-value customers. It’s about investing the right amount of effort into each group to maximise your overall profitability and keep everyone happy.

To put this into practice, you need a clear framework that connects customer value to specific marketing actions. The table below shows a simple but effective way to segment your customer base and decide on the best way to engage each group.

CLV Segmentation and Action Plan

| CLV Segment | Customer Profile | Targeted Marketing Action |

|---|---|---|

| VIPs (Top 5%) | Your most valuable, loyal customers with the highest lifetime spend. | Shower them with exclusive early access, personalised thank-you gifts, and a direct line to your best support. |

| Loyalists (Next 15%) | Consistent repeat purchasers who regularly engage with your brand. | Nurture them with a rewarding loyalty programme, special offers, and content that makes them feel appreciated. |

| Promising Newcomers | Recent customers who have shown high initial spend or frequency. | Engage them with a strong onboarding experience and personalised follow-ups to encourage their next purchase. |

| At-Risk Customers | Customers whose purchasing frequency or spending has noticeably dropped off. | Target them with a re-engagement campaign, offering a compelling reason to return, like a special discount. |

This segmented approach ensures that every pound you spend on marketing is working as hard as it possibly can. For your VIPs and Loyalists, you might invest more in retention. For acquiring new high-potential customers, you can get smarter with your PPC campaigns.

For example, this CLV data is gold dust for refining your bidding in Google Ads. It’s a key part of the strategy we outline in our guide on how to increase your ROAS with Performance Max. When you understand the long-term value of a specific customer type, you can confidently spend more to acquire them, knowing that the initial investment will pay off handsomely down the line.

Right, so you’ve figured out how to calculate your Customer Lifetime Value. That’s a massive first step, but honestly, it’s just the starting line. The real prize is making that number climb.

A higher CLV isn’t just a vanity metric; it means more revenue, stickier customers, and a much healthier business overall. This isn’t about finding a single magic trick. It’s about a series of smart, deliberate investments across the entire customer journey.

Let’s shift gears from calculation to action. We’re going to walk through some proven, practical tactics you can use right away to turn one-time buyers into loyal brand advocates who drive real, sustainable growth.

Perfect the Post-Purchase Experience (How to Calculate Customer Lifetime Value)

The moments immediately after a customer clicks “buy” are pure gold. Their excitement is at its peak, and your brand is front and centre in their mind. This is your chance to make a lasting impression that a simple order confirmation email just can’t match.

A fantastic post-purchase experience reassures them they made the right call. Think about sending a personalised thank-you video, giving them crystal-clear and proactive shipping updates, or even slipping a small, unexpected gift into their package. These little touches are what transform a transaction into a relationship, laying the foundation for their next purchase before the first one has even arrived.

Build Loyalty Programmes with Real Value

Let’s be honest: many loyalty schemes are just glorified discount programmes. To genuinely boost CLV, your programme has to build an emotional connection. It should make customers feel like they’re part of an exclusive club, not just another number on a spreadsheet.

Here in the UK, with customer acquisition costs soaring, loyalty programmes are an absolute cornerstone for growing CLV. A deep dive into about 60 top UK loyalty schemes revealed that the best ones do far more than just reward purchases. They create emotional bonds through exclusive rewards, community-building, and even charity partnerships, turning casual shoppers into die-hard fans. You can see the full analysis on Tryzens.com to get a better idea of how leading brands pull this off.

Key Insight: Don’t just throw points at them. Think about what your best customers actually value. Is it early access to new products? Invitations to special events? Or maybe a dedicated support line? Make the rewards meaningful and something to aspire to.

Use Customer Feedback Proactively

Your customers are constantly telling you how to make your business better—you just have to listen. Actively gathering and, crucially, acting on customer feedback is a powerful way to keep them around. When people see you making changes based on their suggestions, it proves you respect their opinion and are genuinely committed to making things better for them.

- Send targeted surveys: After a purchase or a support chat, ask for specific feedback. Keep it short and to the point.

- Monitor social media: Keep an ear to the ground. What are people saying about you online?

- Close the loop: This is the most important part. When you implement a change based on feedback, tell your customers! A quick email saying, “You asked, we listened,” works wonders for building goodwill.

Master Intelligent Upselling and Cross-Selling

Once you have a good handle on your customer segments, you can use email marketing and on-site recommendations to upsell and cross-sell without being annoying. This isn’t about spamming them with irrelevant offers. It’s about anticipating their next need and suggesting products that genuinely improve their experience.

For example, if someone buys a high-end coffee grinder from you, follow up with recommendations for premium single-origin beans that would be perfect for it. This shows you understand their journey and are there to help them get the most out of what they bought. This kind of strategic approach not only nudges up the average order value but also cements your status as a trusted expert. In the long run, this all feeds into a higher CLV and a much stronger return on ad spend, a concept we dig into in our guide to achieving a good ROAS.

Common CLV Questions Answered

As you start weaving Customer Lifetime Value into your business strategy, a few practical questions are bound to pop up. It’s one thing to know the formula, but applying it in the real world throws up some nuances. This section tackles the most common queries we get, giving you clear, straightforward answers to help you use CLV insights with total confidence.

Think of this as your go-to guide for getting over those first few humps and making CLV a genuinely useful metric for your brand.

How Often Should I Calculate CLV?

One of the first questions we always hear is about timing. Should this be a daily, weekly, or monthly report? For most businesses, calculating CLV on a quarterly or semi-annual basis hits the sweet spot.

This frequency is ideal. It’s often enough to let you spot trends, see the real-world impact of your marketing, and make smart adjustments. At the same time, it stops you from getting bogged down in endless number-crunching, which can easily lead to “analysis paralysis” where nothing actually gets done.

However, there are exceptions. If your business is highly seasonal—like a retailer that makes most of its money over Christmas—or you’re in the middle of a huge campaign launch, you might want to check it more often. For instance, running the numbers after a big sale can give you immediate feedback on the long-term value of the new customers you just brought in.

What Is a Good Customer Lifetime Value?

This is the million-dollar question, isn’t it? But the honest answer is, there’s no single magic number for a “good” CLV. A figure that’s amazing for a low-cost subscription box would be a complete disaster for a high-end furniture store. The number is totally dependent on your specific industry, your business model, and, most importantly, your Customer Acquisition Cost (CAC).

The real benchmark isn’t the CLV figure on its own, but how it stacks up against your CAC. It’s the CLV:CAC ratio that truly tells you about the health of your business.

A healthy ratio is widely considered to be 3:1. This simply means the total value a customer brings in is three times what it cost you to get them. A ratio below this could signal you’re overspending on acquisition, while a much higher ratio might mean you’re underinvesting in marketing and leaving growth on the table.

Your main goal should always be to improve your own CLV over time, making sure it stays comfortably ahead of what you spend to earn that customer.

Can I Calculate CLV Without Much Historical Data?

Yes, you absolutely can, but it calls for a slightly different approach and a bit of educated guesswork. If you’re a new business without years of sales history to pull from, calculating a precise historical CLV is obviously not on the cards.

In this scenario, you’ll need to lean on a few things:

- Industry Benchmarks: Do some digging. Look up average customer lifespans and purchase frequencies for businesses similar to yours.

- Educated Estimates: Be realistic and make some assumptions based on your business plan and what you’ve seen from your first few customers.

- Early Data Tracking: This is the most crucial part. Start tracking everything meticulously from day one. Even a few months of sales history can give you some initial insights to build on.

Your first CLV calculation will be an estimate, but that’s okay—it’s a starting point. As your business grows and you gather more data, you can keep refining the calculation, making it more accurate over time. Don’t let a lack of history stop you from starting.

Should I Include Operational Costs in My CLV Calculation?

For a more accurate and strategically useful picture of profitability, the answer is a firm yes. A simple CLV based on revenue tells you how much a customer spends, but it doesn’t tell you how much profit they actually generate for your business.

To get a much clearer picture, you should calculate CLV using gross margin instead of just revenue.

To do this, you simply subtract the Cost of Goods Sold (COGS) from your average purchase value. If you’re a service-based business, this would be the direct cost of delivering that service. This simple tweak ensures you’re measuring the real profit a customer contributes over their lifetime.

This “profit-adjusted” CLV is incredibly powerful. It helps you make much smarter decisions about your marketing spend, especially within your paid media campaigns. Knowing the true profitability of a customer lets you be more aggressive and effective with your bidding—a key element we often dig into during a comprehensive PPC audit to make sure every penny of ad spend is delivering real returns.

At PPC Geeks, we specialise in transforming data like CLV into powerful, data-driven PPC strategies that drive measurable growth. If you want to ensure your ad spend is acquiring high-value customers and delivering sustained ROI, find out how our expert team can help. Learn more at https://ppcgeeks.co.uk.

Author

Search Blog

Free PPC Audit

Subscribe to our Newsletter

The Voices of Our Success: Your Words, Our Pride

Don't just take our word for it. With over 100+ five-star reviews, we let our work-and our satisfied clients-speak for us.

"We have been working with PPC Geeks for around 6 months and have found Mark and the team to be very impressive. Having worked with a few companies in this and similar sectors, I rate PPC Geeks as the strongest I have come across. They have taken time to understand our business, our market and competitors and supported us to devise a strategy to generate business. I value the expertise Mark and his team provide and trust them to make the best recommendations for the long-term."

~ Just Go, Alasdair Anderson