PMax Channel Reporting: Google Lifts the Veil on the Black Box

PMax Channel Reporting: Performance Max has long been the mystery box of Google Ads – a one-stop campaign that spreads ads across Search, YouTube, Display, Gmail, Discover, and Maps, but historically told you precious little about where your budget actually went.

For PPC marketers, running a PMax campaign often felt like playing a slot machine: you feed in your budget and hope for a jackpot, with only aggregate results to show for it. At Google Marketing Live 2025, however, Google finally cracked open that black box and gave advertisers what they’ve been clamouring for – Performance Max Channel Performance Reporting. This bold new update promises to reveal which channels are truly driving the conversions (and which might be guzzling spend), injecting a dose of much-needed transparency into the PMax formula.

In this I will break down what the new PMax Channel Reporting is, how it works, and why it’s such a game-changer for PPC professionals, CMOs, brand owners, and e-commerce marketers. We’ll also dive into expert reactions – from enthusiastic applause to a few skeptical side-eyes – and explore how this feature could reshape budget strategies and media mixes going forward. Buckle up, because the veil is lifting and Google’s PPC magicians are finally handing us a peek at their trick.

What is Performance Max Channel Reporting?

Performance Max Channel Performance Reporting is a new set of reporting features that gives advertisers a clear, channel-by-channel breakdown of their PMax campaign results.

In plain English: you’ll finally see how your PMax ads perform on each Google channel – Search, Shopping (Search ads with product listings), YouTube, Display, Discover, Gmail, Maps, even Search Partners. No more squinting at one lump-sum performance number and guessing which platform did the heavy lifting.

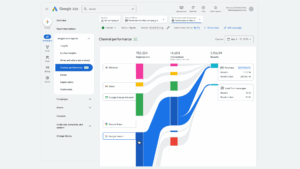

On the new “Channel performance” page (accessible via the Insights & Reports tab in Google Ads), you’ll find:

-

A visual breakdown by channel – a slick data visualization (think charts or graphs) illustrating which channels your customers engaged with and how each contributed to your conversion goals. At a glance, you might see, for example, Search contributed 60% of conversions, YouTube 25%, Display 10%, etc., in a given campaign.

-

Channel-specific metrics – a granular table listing key performance metrics for each channel, including impressions, clicks, cost, conversions, conversion value, and more. It’s essentially an itemized receipt for your PMax spend – revealing whether your budget is mostly driving high-intent Search clicks or being siphoned into, say, YouTube views that never convert.

-

Downloadable reports – the channel performance table can be easily downloaded as a file blog.google, so you can share with your team or import into your own dashboards. Finally, your spreadsheets can have columns for each channel’s stats, instead of one opaque column labeled “PMax”.

-

Diagnostics and tips – Google has baked in intelligent diagnostics on this page to flag potential issues or missed opportunities on specific channels. If a channel isn’t pulling its weight, the interface might clue you in on why. For example, if your Maps placements are flat, the system might suggest adding a location asset (so your ads can show on Maps). If Search conversions are lower than expected, you might see a nudge that your landing pages aren’t relevant enough and a reminder to enable Final URL Expansion to let Google help match user intent. In short, it’s like getting actionable tips per channel – a PPC coach whispering in your ear, “Psst, you’re missing out on Maps because your store locations aren’t linked.”

In essence, Channel Reporting turns Performance Max from a single blurry painting into a multi-panel masterpiece – each panel representing a channel’s performance. You can click on a specific channel in the report to dive deeper into that channel’s contribution and trends. For example, a home & garden retailer might discover they’re crushing it on YouTube, leading them to double down on video creatives to fuel even more conversions. The same report might show that ads using product data (Shopping-style ads) have declined month-over-month, prompting the retailer to spruce up their product feed imagery and titles. All of this insight was essentially invisible before – now it’s served up on a silver platter.

Bonus: Channel reporting also includes format-level breakdowns. This means you can differentiate how various ad formats perform across channels If you’re an e-commerce brand, you can see how ads with product feeds (e.g. Shopping ads on Search, product carousels on YouTube, dynamic remarketing on Display) did versus standard text or image ads. If you’re heavy on video, you’ll see how video ads contributed on YouTube and on any video placements across Display. It’s a holistic view of not just channel, but the creative formats driving your results. For data-driven marketers, this is Christmas morning.

Why Marketers Demanded This: PMax’s Transparency Problem

To appreciate why Channel Performance Reporting is such a big deal, we need to rewind to the pain points it addresses. Since its launch, Performance Max has been a black box in the truest sense. Advertisers pour money in and get conversions out, but where that money goes inside Google’s machine has been largely hidden. Prior to this update, you couldn’t tell if PMax was showing your ads predominantly on Search versus Display, or YouTube versus Gmail. You had one blended performance line item. This lack of transparency has been a source of frustration – and sometimes outright distrust. Fool me once… as one skeptical advertiser quipped upon hearing the news.

For years, the cry from PPC professionals has been “We need more visibility!”. Advertisers wanted to know which channels were actually driving value so they could optimize accordingly (or decide if PMax was worth the spend at all). In fact, Google quietly started testing channel reporting earlier in the year after significant feedback. As one industry journalist put it, after nearly five years of PMax being opaque, Google is “finally opening up” this black box – a shift significant enough to potentially rebuild trust among the 1M+ advertisers using Performance Max.

Before this update, some power-users resorted to clever (and clunky) workarounds to infer PMax channel mix. One popular solution was a third-party script by Mike Rhodes that tried to parse out PMax’s performance by channel using the Google Ads API. It was a lifeline for many advanced advertisers, but it was also a hack – something that had to be manually added and maintained, and never officially supported. The fact that Google’s own reps often pointed frustrated advertisers to such community scripts spoke volumes. Now, Google is effectively building that functionality into the native interface, admitting that yes, channel transparency matters.

Transparency issues weren’t just a matter of nerdy curiosity; they had real business implications. For example, agencies doing account audits often found shocking imbalances once they dug in with custom analysis – cases where over 80% of conversions were coming from Shopping ads, while huge chunks of budget silently bled away on Display or YouTube with minimal return. Imagine telling a client their PMax campaign that “seemed” to be working was actually propped up by one channel, and that they’d been unknowingly wasting money on others. Without official channel reporting, these insights were hard to come by and often came after a lot of spend. No wonder some advertisers have been hesitant to embrace PMax fully.

Google clearly heard the feedback (perhaps the pitchforks and torches were getting too hard to ignore). In their announcement, Google explicitly acknowledged that advertiser feedback drove these changes, noting that they implemented 90+ improvements to PMax in 2024 and that better reporting and transparency were top requests. The new channel breakdown, alongside other reporting updates, is Google’s answer to deliver “clearer insights and increased control—without sacrificing the benefits of automation”searchenginejournal.com. In other words, Google wants to give us visibility while keeping PMax’s AI engine humming in the background.

How Does Channel Performance Reporting Work?

So how do you actually use this fancy new reporting, and what should you expect? First off, as of GML 2025, Channel Performance Reporting is rolling out in open beta. Google announced that the open beta would begin a few weeks after the event (late May 2025) and invited interested advertisers to sign up for access. In practice, this means not everyone will see the feature immediately; you may need to request access via your Google account rep or wait until the beta expands. (PPC Geeks pro-tip: if you’re keen, reach out to your Google Ads rep yesterday and get on that beta list!).

Once enabled, you’ll find the Channel Performance report in the left navigation of Google Ads, under the Insights & Reports section. It’s at the campaign level for Performance Max campaigns. Click on a PMax campaign, and then navigate to Insights/Reports → Channel Performance. There you’ll be greeted with the new dashboard: likely a big multicolor chart up top and a table below it. The chart visualizes performance share by channel (e.g. a bar or pie chart of conversion share, or a trend line by channel over time), helping you immediately grasp which channels dominate your results. The table then provides the numbers behind it, which you can sort, filter by date, etc. If you love data, this is your playground.

One neat aspect: you can drill down by channel. See a spike in Display conversions? Click on “Display” in the chart or table – the interface will show more details, potentially even which placements or Google network partners were most active. See a dip in YouTube performance last week? Zoom into YouTube and check if maybe a particular video asset underperformed. The integration of channel data with asset and placement data is a killer combo. In fact, on the Channel Performance page, Google includes quick links to relevant existing reports – for example, a link to Placement reports for your Display and YouTube traffic. It’s as if Google is saying, “Here’s the channel that’s doing well or poorly – now, with one click, go see where within that channel your ads showed.” For Search, you’ll likely get links to the new Search Terms report (more on that soon), and for Maps, maybe a nudge to check your Locations report. This interconnected reporting is a welcome UX improvement.

Rollout Details and Caveats: PMax Channel Reporting

It’s worth noting a couple of caveats and technical details. During the beta, Channel Reporting is available in the Google Ads UI only, not via the API or Google Ads Editor. So, fancy dashboard builders and script aficionados will have to wait a bit longer to pull this data automatically. Google has indicated that API support is on the roadmap (similar to how Search term data is UI-only at launch with API support coming later).

Also, while you’ll see what each channel is doing, you still can’t directly control PMax budgets or bids by channel. That hasn’t changed – PMax will continue to autonomously allocate budget across channels based on its AI’s quest for conversions. As PPC expert Kirk Williams aptly put it, Google has moved from a “black box” to a “glass box” – now you can see what’s happening inside, but you “still can’t fully control it.”.

There are no channel-level switches or sliders (yet). For example, you might discover that Display is spending a lot with little return; unfortunately, you cannot just tell PMax “hey, cut Display out” or set a specific budget cap for Display. The best you can do is use the insight to adjust your strategy (e.g. provide better Display creative, or exclude certain placements via account-level placement exclusions, or if it’s really bad, consider splitting off into separate campaigns). In short, insight precedes control – and we’ve now got the insight, but not the granular control. Some advertisers remain eager for the day Google might allow optional channel controls in PMax; however, Google’s philosophy so far has been to keep PMax as a fully unified campaign. Don’t hold your breath for manual dials on channel budgets in the immediate future.

Another limitation: ROAS or CPA targets by channel are not available. PMax still optimizes to your overall goal across all channels. If, say, Search is your highest-ROAS channel and Display your lowest, you can’t set different ROAS targets per channel – so the overall average might get pulled down by the lower performer. Channel reporting will at least make this visible so you can take action (maybe running a separate Display campaign if needed, or improving your Display ads), but it doesn’t let you tell the algorithm “prefer this channel for efficiency.”

One more small caveat: privacy thresholds still apply to query-level data. When we talk about the accompanying Search Terms report (yes, PMax is also finally getting a real search query report!), Google will still mask queries that are too low-volume or sensitive. But the channel performance data is aggregated enough that privacy shouldn’t hide anything there – you’ll see the full picture of each channel’s performance, just not every single user query.

Finally, as with any beta feature, expect some rough edges. Early testers have noted that the Channel Performance page is a huge leap forward, but you may encounter minor quirks – perhaps slight data lags or channel numbers that don’t 100% reconcile with other reports on the same day (at least until it’s fully rolled out). Google will likely refine the feature based on feedback during the beta. Full release timeline? Google hasn’t given an exact date, but if open beta goes well over the coming weeks, one could speculate that channel reporting will be globally available to all PMax advertisers later in 2025. Keep an eye on Google’s announcements and the Google Ads release notes for that update.

How Will This Change Your Optimisation Game?

The consensus among PPC geeks is that channel reporting in PMax isn’t just a shiny new report – it’s a fundamental shift in how we can strategize with Performance Max. Here are a few major ways this feature is poised to impact optimization and planning:

-

Smarter Budget Allocation: With channel-level data, marketers can identify which channels are scaling profitably and which are just eating budget If the report shows that Search and Shopping placements deliver a £50 CPA while Display is coming in at £200+ CPA, that’s a clear signal to re-evaluate your strategy. Maybe you’ll choose to carve out a separate Display campaign with tighter targeting, or simply invest more in creative for the better-performing channels. Before, you only had a blended CPA, so you might not realize how much a weaker channel was dragging you down. Now, you can invest with eyes wide open. As one PPC expert noted, a brand spending six figures on PMax can now pinpoint which slices of that spend are profitable – and which are not – down to the channel level. That’s huge for governance and accountability of ad spend.

-

True Multi-Channel Strategy: Many advertisers treated PMax as essentially a glorified Shopping campaign (especially retailers who saw most conversions come from Shopping ads). With channel reporting, you can start treating PMax for what it truly is: a multi-channel campaign that reaches customers at different touchpoints. Now you’ll see if, say, YouTube ads are assisting a lot of conversions (even if those users convert later via Search). This might encourage you to produce more video content or adjust your messaging by channel. It elevates PMax from “just turn it on and cross your fingers” to a strategy where you can coordinate channel-specific creatives and funnel tactics. Essentially, you can play both the macro game (total conversions) and the micro game (per-channel performance) at once.

-

Better Creative and Asset Optimization: The new data doesn’t stop at channels. Google also announced expanded asset-level reporting (for example, you’ll see metrics like impressions, clicks, conversions for each headline, description, image, and video in your ads). Combining this with channel insights is powerful. For instance, if your report shows YouTube is a star channel, you can jump to your asset report and identify which video assets worked best. Then you might decide to produce more videos of that style or message. Alternatively, if Discover and Display are spending a sizable chunk but yielding few conversions, check your image assets – perhaps your creatives aren’t resonating on those channels. You might find that certain ad elements perform great on Search (text-based), but fall flat on more visual channels, or vice versa. Now you have the data to back those hunches and iterate. As Google’s Vidhya Srinivasan mentioned at GML, it’s about pairing AI power with human creativity – you supply better assets, and the system will have an easier time driving results.

-

Enhanced Reporting to Stakeholders: Anyone who’s had to report PMax results to a client or CMO knows the awkward conversation of “No, unfortunately I can’t tell you how much of this came from YouTube vs. Search…”. Those days are over. With channel reporting, you can provide a clean breakdown of performance by channel, which is especially useful if different stakeholders care about different outcomes. Your brand team might be thrilled to see how much YouTube drove top-of-funnel engagement, while your performance team can zero in on Search ROI. If one channel aligns with certain KPIs (like new customer acquisition) and another with different KPIs (like ROAS), you can now separate those in your reporting. This kind of clarity can improve internal decision-making and get everyone on the same page. As Kirk Williams noted, transparency allows clearer internal reporting, especially when stakeholders have varying priorities (e.g. awareness vs acquisition). In short, it builds confidence. Some marketers who were skeptical of PMax may now trust it more – or at least have the data to justify their budget to the higher-ups.

-

Media Mix and Channel Planning: Beyond just Google Ads, these insights could influence your wider media mix. Suppose you learn that PMax is driving a ton of cheap conversions on YouTube for your brand. That might lead you to allocate more budget to YouTube in your overall marketing mix (maybe you’ll launch a dedicated YouTube campaign or cut back a bit on another channel outside Google that’s less efficient). Or, if you find PMax isn’t utilizing one channel much (maybe your PMax hardly ever uses Gmail or Discover), you might choose to run separate campaigns to capture those if you believe they have untapped potential, or conversely, decide those channels aren’t critical for your audience. Channel reporting gives you a map of where Google’s automation thinks the low-hanging fruit is. That can validate or challenge your own assumptions. It’s like getting a free market research report on which channels work for your business.

Expert Perspectives: Applause, Caution, and Wit

The PPC community had feelings about this update – and they didn’t hold back. Overall, the sentiment was strongly positive. After all, we’ve been asking (begging, pleading) for these transparency features for a long time. “This is a long-overdue improvement,” noted Kirk Williams, founder of ZATO Marketing, adding that it finally replaces the need for third-party hacks and starts to deliver on the transparency promise Google made with PMax. Many experts echoed this “about time!” response. It’s not often that Google Ads announcements get universal praise, but this one came close.

PPC thought leader Brooke Osmundson pointed out that improving attribution and transparency was a major theme at GML 2025 – channel reporting being a key step in that direction wordstream.com. Marketers are relieved that they can now actually see where PMax is finding conversions. The update was framed as “giving advertisers greater transparency into campaign performance across all Google surfaces.” In other words, Google is conceding that black box automation isn’t enough; advertisers need to trust the system, and trust comes from visibility.

Dan Trotter, co-founder of PPC Geeks, didn’t mince words on the impact for brands. “For brands, this is a game-changer,” Trotter says. “It’s like Google finally handed us a map for the treasure hunt we’ve been funding all along. We can now see exactly where our money is going and which channels are delivering the gold. This kind of insight lets us allocate brands budgets with far greater confidence – we’re talking the ability to shift strategy on a dime because you actually know what’s happening. Performance Max went from a trust fall to a more transparent partnership. For any brand that ever asked ‘is my PMax budget actually working for me?’, now you’ll have your answer.” According to Trotter, this transparency will push brands to invest even more boldly in PMax campaigns, now that they can justify and tweak them with real data. “It changes the game when you can walk into a board meeting with a colorful chart showing which channels drove what. That’s the kind of clarity that gets CMOs excited – and that makes brands more willing to lean into PMax as a core strategy.”

Other industry voices brought a mix of excitement and caution. Some local marketing experts highlighted that this is especially good news for local businesses and SMEs. If you’re a small business using PMax to advertise locally, you’ll now see the impact on Maps and local search – something that can help you understand if PMax is driving foot traffic or calls. “Channel and asset level reporting is going to be a big deal for local businesses using PMax,” one expert noted, explaining that local advertisers can finally quantify how much of their campaign is going to local Maps results, etc., and adjust their local SEO/Ads strategy accordingly. No more flying blind on whether those store visits are coming from Google Maps ads or elsewhere.

On social media, PPC nerds were practically doing happy dances. Memes about “PMax peeking out of its shell” circulated. One widely-liked tweet joked that Performance Max must have heard the collective screams of marketers in reporting hell and decided to throw us a bone. Another commenter quipped, “Google giving us channel data in PMax? Hell must’ve frozen over – but I’ll take it!” It’s rare that an Ads feature release gets this kind of fanfare, but when you’ve been kept in the dark for so long, even a 40-watt lightbulb feels blindingly bright.

Of course, not everyone is throwing a party. A few seasoned advertisers offered a reminder not to get too excited. “Transparency is great, but we still lack control – don’t confuse the two,” warned one LinkedIn comment, referencing the earlier point that you can see channels but can’t tell Google how to redistribute budget between them. There’s also a contingent that remains wary of Google’s motivations. Skeptics might say Google is only doing this now to encourage more adoption of PMax (true, they probably are), or that they’re making a concession here while taking away something elsewhere. A bit of healthy skepticism never hurts – but even cynics generally agree that getting data you didn’t have before is a positive move.

One particularly bold take from AdExchanger’s James Hercher framed it like this: these changes are a “key transparency concession” from Google, almost an acknowledgement that in order to win more of advertisers’ budgets, they had to give us more insight. It’s a big shift in Google’s approach – from a stance of “trust the machine, we know best” to “okay, here’s a look under the hood, let’s work together.” As Hercher mused, the real question is whether these changes will be enough to rebuild trust in PMax for those who were skeptical. Only time (and performance data) will tell, but it’s a step in the right direction.

What’s Next: A New Era of PPC Transparency?

The introduction of Performance Max Channel Reporting marks a turning point in Google Ads’ balance between automation and control. It’s part of a broader wave of features unveiled at GML 2025 aimed at appeasing advertisers’ calls for clarity. Alongside channel breakdowns, Google also rolled out full Search Terms reporting in PMax (yes, you can now see actual search queries that triggered your PMax ads, and even add negative keywords accordingly). We also saw expanded asset insights and other measurement tools. It’s as if Google said, “Alright, alright, we hear you – here are the tools to understand and trust our AI a bit more.”

For marketers, this is an invitation to re-engage with PMax on a deeper level (PMax Channel Reporting). If you were running PMax on autopilot, now’s the time to pop open those reports and dig into the nuggets of insight. You might discover quick wins: channels where a small tweak could unlock more performance, or inefficiencies you can correct now that they’re visible. It’s also a call to get more strategic. The best marketers will use this data not just to observe, but to act – crafting channel-specific creative, adjusting budgets across their portfolio, and informing their broader marketing mix. The savviest will even combine these insights with first-party data and backend metrics. For example, you might find YouTube leads have a lower immediate conversion rate, but perhaps those users have a higher lifetime value – something you’d only know by blending channel data with your CRM data. Now that you have the channel breakdown, such analyses become easier.

There are also implications for budget planning. Some advertisers who previously split budgets into multiple campaign types (Display campaigns, YouTube campaigns, etc.) might consolidate more into PMax if they feel the reporting gives them sufficient oversight. Others might do the opposite – using the PMax channel data as a guide for where to invest in standalone campaigns. For instance, if channel reporting shows that PMax is killing it on Search but lackluster on Display, an advertiser might choose to allocate more budget to regular Search campaigns (to capture more search demand directly) and perhaps run a separate Display or Discovery campaign where they can control targeting more tightly. In essence, Channel Reporting could lead to a rebalancing of how marketers divvy up their budgets between PMax and other tactics.

From Google’s perspective, these updates are also about solidifying PMax’s role at the center of advertising strategies. At GML, they introduced the concept of the “Power Pack”, a trio of campaign types (the upgraded PMax, new AI-powered Search campaigns called AI Max, and Demand Gen for social-like reach) meant to cover the full funnel. Performance Max is the backbone of this pack, and giving advertisers more transparency is likely to spur more adoption. Google wants PMax to be trusted enough that advertisers of all sizes use it as a default, not an experiment. With channel reporting and other fixes, they are removing reasons not to use PMax. We’re already hearing about many brands planning to scale up PMax budgets now that they can truly monitor and optimize it with confidence.

Final Thoughts

PMax Channel Reporting: In the witty words of one PPC geek, “Google finally gave us PMax nerds the x-ray glasses we’ve been asking for.” And it’s true – we can now see through the walls of the PMax black box. Performance Max Channel Reporting delivers transparency that was long overdue, and the industry response shows just how welcome it is. It empowers advertisers to make more informed decisions, to strategize by channel, and to back up their instincts with data. It also holds Google a bit more accountable – no more hiding behind aggregated results when something isn’t working. As advertisers, we should take this as an opportunity to up our game: leverage these insights to optimize campaigns like never before, justify those marketing dollars, and experiment with newfound knowledge of where and how PMax is succeeding or struggling.

To be sure, there’s still a wish list. We’d love to eventually see channel-level levers (even if just gentle nudges). We’d love the ability to exclude certain channels entirely if they’re not right for a brand (for now, one workaround is using account-level negatives or placement exclusions to indirectly shape PMax, but it’s not straightforward). However, as one expert put it, insight precedes control, and we’ve now got the insight. Even without direct knobs to turn, knowing is half the battle – and we know more now than we ever did about PMax’s inner workings.

Google’s new channel reporting is a win for advertisers. It shows that even in an AI-driven world, data transparency remains the currency of trust. So go forth, dive into your Performance Max Channel reports, and embrace the clarity. The black box has become at least a glass box, and the view from here is already much better. Happy optimizing, and may your multi-channel insights be ever in your favor!

📌 Performance Max Channel Reporting – FAQs

Q1: What is Performance Max Channel Performance Reporting?

A: It’s a new reporting feature in Google Ads that shows how your Performance Max campaigns perform across each individual Google channel—like Search, Display, YouTube, Gmail, Discover, Shopping, and Maps. It breaks down impressions, clicks, costs, and conversions by channel, so you know exactly where your ad spend is going.

Q2: Why is this update important for advertisers?

A: Because it finally adds transparency to Performance Max, which was previously criticised for being a “black box.” You can now see which channels are driving results—and which aren’t—so you can make smarter decisions, optimise creative assets, and allocate budget more effectively.

Q3: Where can I find this report in Google Ads?

A: Once enabled, go to your Performance Max campaign > Insights & Reports > Channel performance. There you’ll find a visual overview and detailed table of channel-level data.

Q4: Is this feature available to everyone now?

A: As of May 2025, it’s in open beta. Many advertisers already have access, but if you don’t see it yet, speak to your Google Ads rep or keep an eye out—it should roll out more broadly by early Q3 2025.

Q5: Can I control budgets or bids for each channel in Performance Max?

A: Not directly. This update shows how each channel performs, but you still can’t manually allocate spend to specific channels in PMax. It’s about visibility, not control (yet!).

Q6: Does this include ad format data too?

A: Yes! You’ll see how different formats (like product feed ads, video, text, image) perform within each channel. For example, you can evaluate how Shopping-style ads are doing on YouTube vs Search.

Q7: Can I download this data?

A: Absolutely. You can export the channel performance table for use in spreadsheets, reporting decks, or further analysis. Great for agencies and internal marketing teams.

Q8: What actions can I take based on this report?

A: Plenty! You can:

-

Identify high-performing channels to double down on creative for that channel.

-

Spot underperforming channels and improve or exclude placements.

-

Use asset-level data to optimise what’s shown in each channel.

-

Shape your wider media mix based on what’s working inside PMax.

Q9: Can I see this data via the Google Ads API or Google Ads Editor?

A: Not yet. During the beta, it’s only available through the Google Ads UI. API and Editor support are expected later in the rollout.

Q10: What’s PPC Geeks’ take on this update?

A: As Dan Trotter, Co-Founder of PPC Geeks, puts it:

“It’s like Google finally handed us a map for the treasure hunt we’ve been funding all along. This kind of insight lets us allocate brands budgets with far greater confidence.”

Stay Ahead of the Curve with the Latest Google Ads Updates

As Google continues to innovate and enhance its advertising platform, it’s crucial to stay informed about the latest developments. If you found this post insightful, check out these related articles that dive deeper into other recent updates and strategies for optimising your PPC campaigns:

-

Performance Max Channel Performance Reporting – Discover how channel-level performance insights in Performance Max campaigns can help you make data-driven optimisations.

-

Google’s Creator Partnerships Hub: Redefining Brand-Creator Collaborations – Learn how the Creator Partnerships Hub is revolutionising influencer marketing within Google Ads.

-

Enhanced Incrementality Testing: Beyond A/B Experiments – Explore how enhanced incrementality testing can unlock more accurate ROI insights for your campaigns.

-

Ads Integration in AI Overviews and AI Mode: A New Era of Search Advertising – Understand how AI-driven search features are integrating ads to improve user engagement.

-

AI Max for Search Campaigns: Unlocking New Potential – Delve into how AI Max is optimising search campaigns to reach new audiences and improve ad performance.

-

Smart Bidding Exploration: Unlocking New Growth for UK Brands – Learn how Smart Bidding Exploration can boost your conversions with AI-driven insights.

-

Search and Shopping Video Ads: Revolutionising Your Google Strategy – Discover how video ads in Search and Shopping campaigns are driving higher engagement and conversion rates.

By keeping up with these recent changes, you’ll be well-equipped to optimise your Google Ads strategies and stay ahead in an increasingly AI-driven landscape.

Author

Search Blog

Free PPC Audit

Subscribe to our Newsletter

The Voices of Our Success: Your Words, Our Pride

Don't just take our word for it. With over 100+ five-star reviews, we let our work-and our satisfied clients-speak for us.

"We have been working with PPC Geeks for around 6 months and have found Mark and the team to be very impressive. Having worked with a few companies in this and similar sectors, I rate PPC Geeks as the strongest I have come across. They have taken time to understand our business, our market and competitors and supported us to devise a strategy to generate business. I value the expertise Mark and his team provide and trust them to make the best recommendations for the long-term."

~ Just Go, Alasdair Anderson